Understanding Medicare Premiums 2025: IRMAA Brackets and Surcharges Explained

Table of Contents

- Income Tax 계산 방법(간편 계산기 포함)

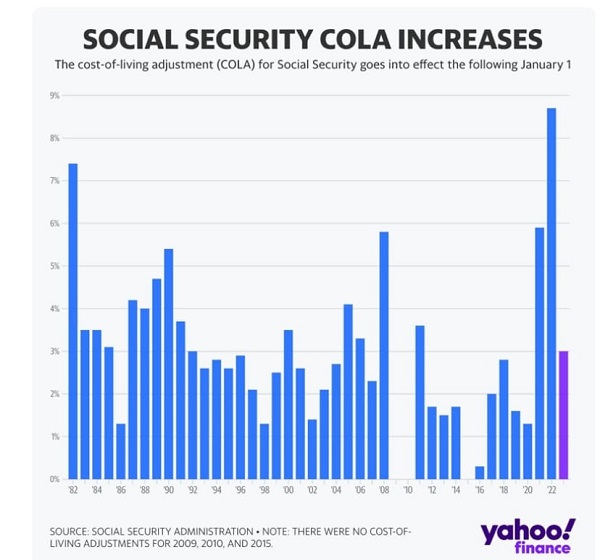

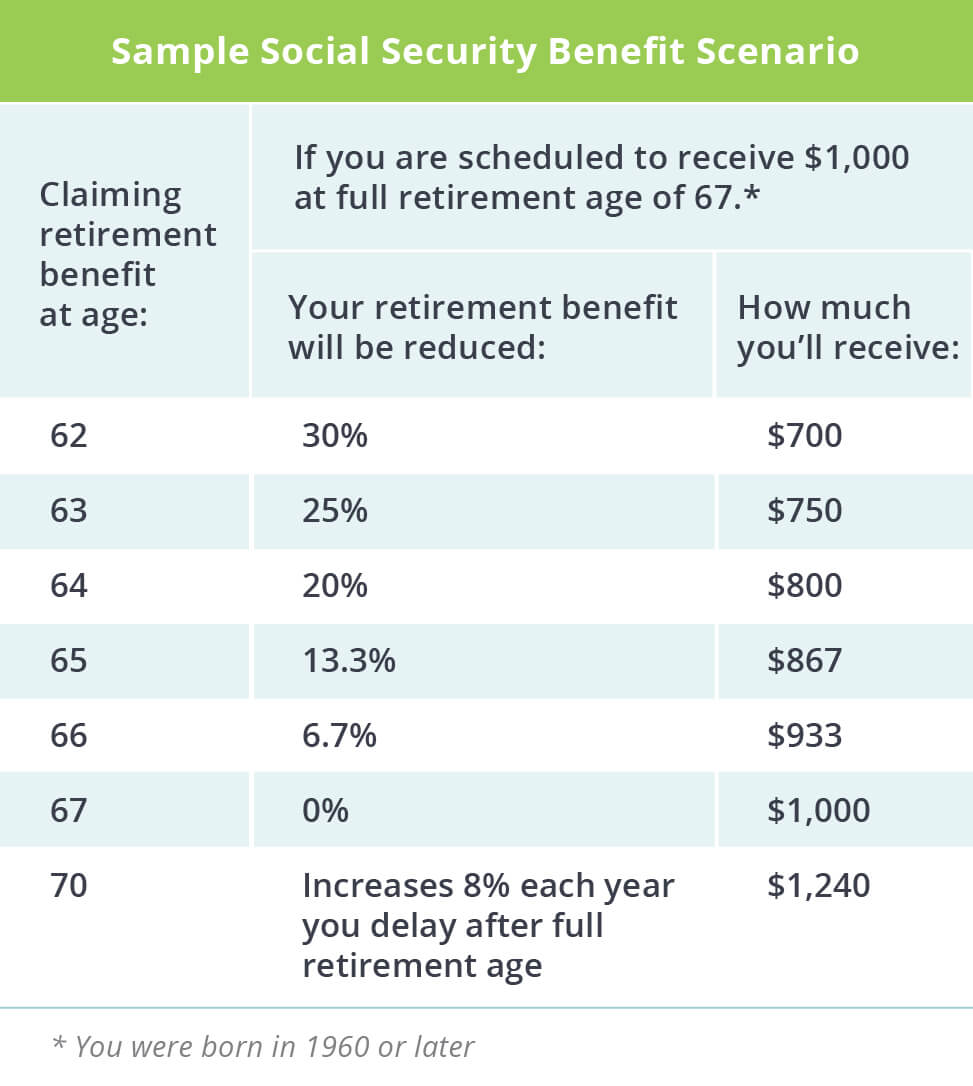

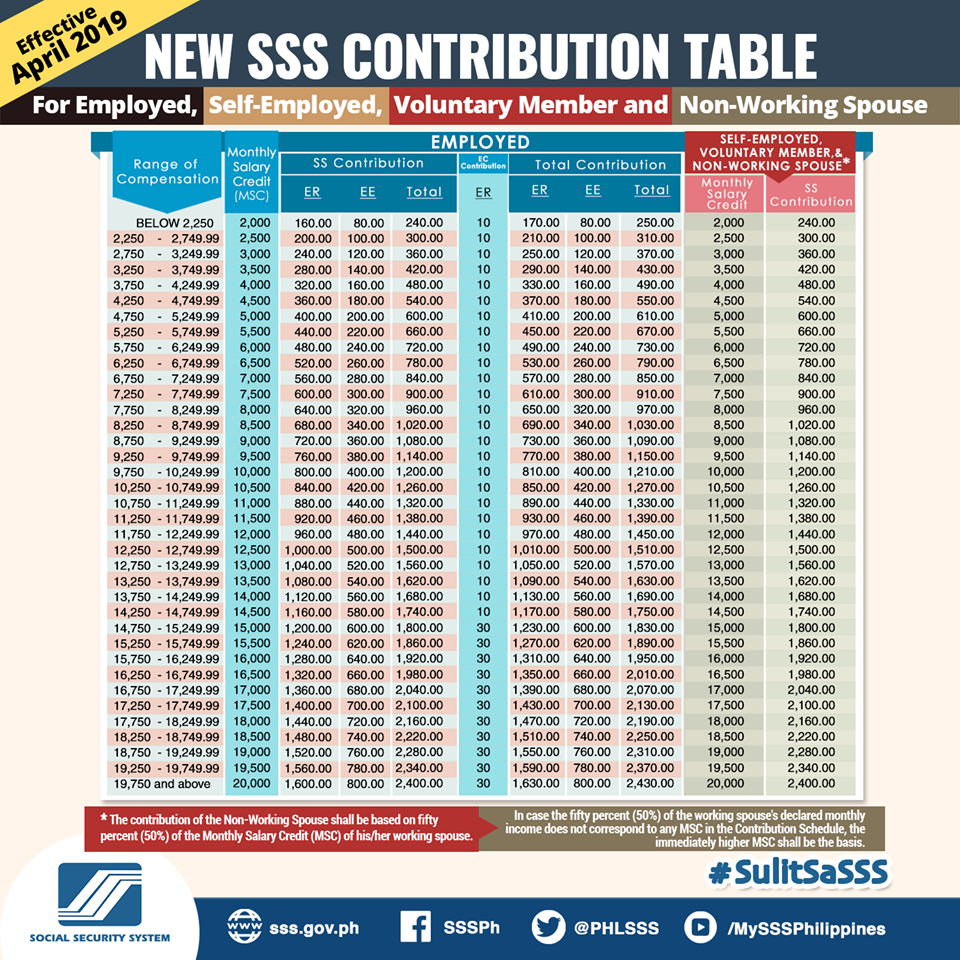

- Social Security Updates for 2024 | Keystone Financial Group

- Social Security Max 2024 Contribution - Toni Agretha

- Trends in the Social Security and Supplemental Security Income ...

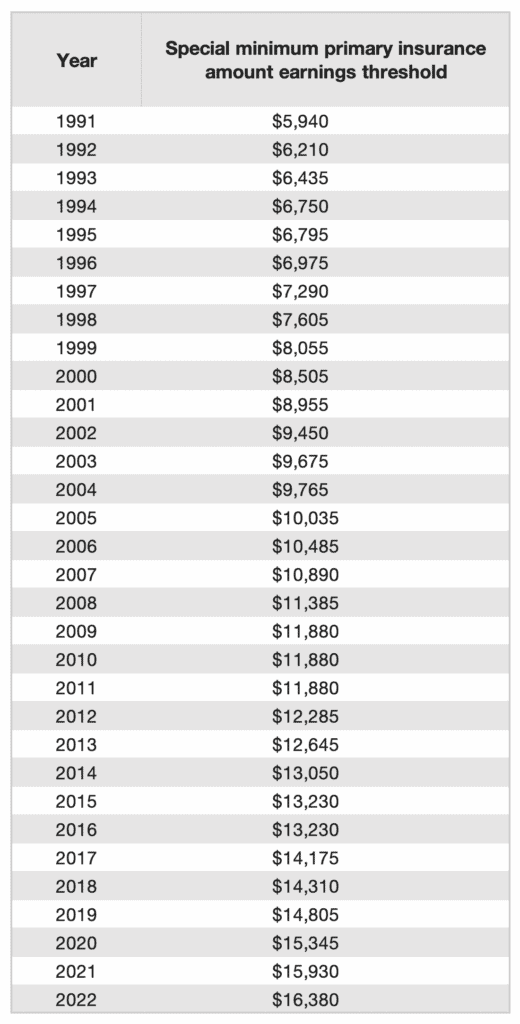

- Minimum Social Security Benefit For 2024 - Matty Shellie

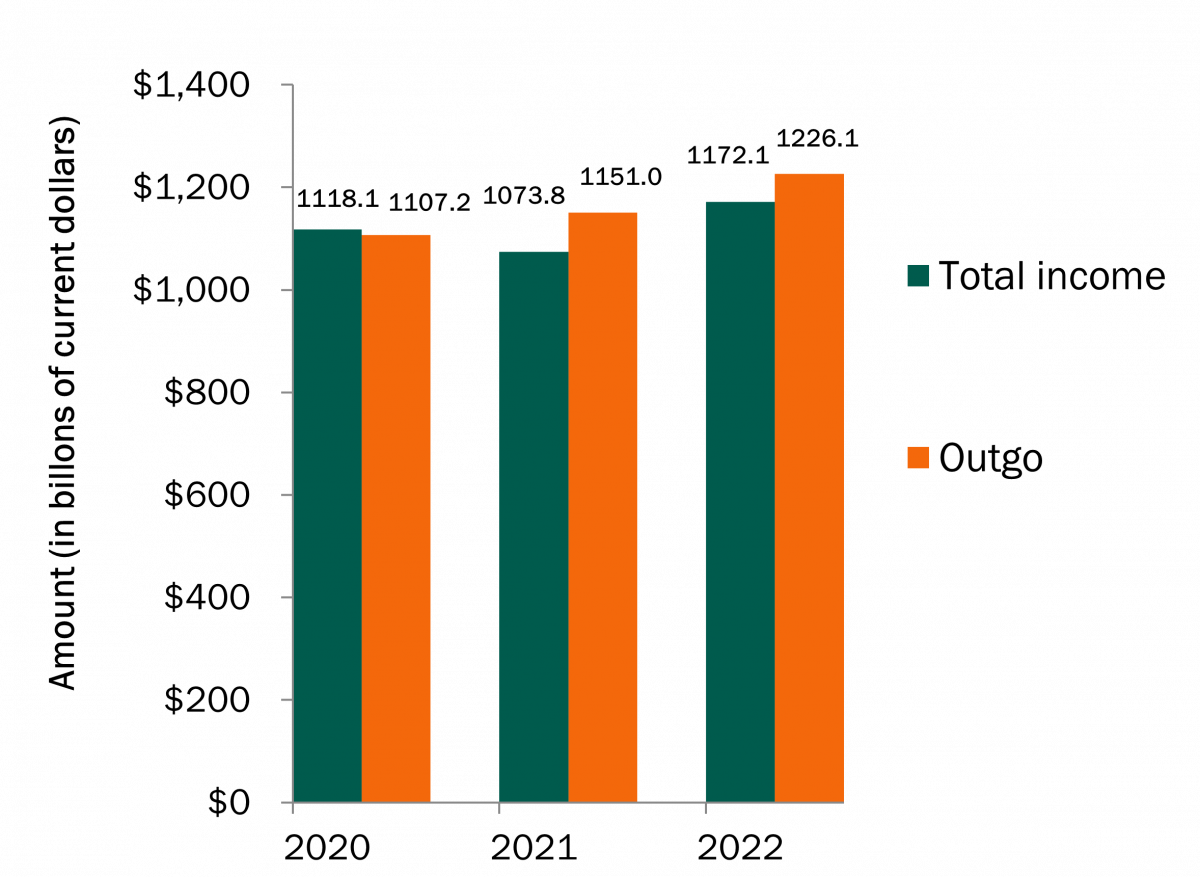

- Is Social Security Going Broke? - The Center For Garden State Families

- Social Security Administration Proposes 2 Much-Needed Changes, But ...

- Social Security Wage Base 2024 Formula Sheet - Debbi Ethelda

- Social Security Benefits, Finances, and Policy Options: A Primer ...

- Is Social Security Going Broke? - The Center For Garden State Families

What is IRMAA?

IRMAA Brackets for 2025

How to Minimize IRMAA Surcharges

While the IRMAA surcharge is mandatory for beneficiaries with higher incomes, there are some strategies to minimize the surcharge: Consider consulting with a financial advisor to optimize your income and reduce your MAGI. Take advantage of tax-deferred savings vehicles, such as 401(k) or IRA accounts, to reduce your taxable income. If you are married, consider filing separately to reduce your joint income. In conclusion, understanding the IRMAA brackets and surcharges for 2025 is crucial for Medicare beneficiaries with higher incomes. By knowing how your income may impact your Medicare premiums, you can take steps to minimize the surcharge and reduce your healthcare costs. Remember to consult with a financial advisor or tax professional to optimize your income and reduce your MAGI. With careful planning, you can ensure that you are getting the most out of your Medicare benefits while minimizing your out-of-pocket costs.For more information on Medicare premiums and IRMAA surcharges, visit the official Medicare website or consult with a licensed insurance agent. Stay informed and take control of your healthcare costs in 2025.